July 6, 2022

Many will tell you it’s cheaper to stay at home with regard to the aging process. While others will tell you it’s more cost efficient to move into a senior living community. Depending on geographic location, caregiver pool, competition in the area, and necessary care, prices are going to vary. One thing that can be agreed on, the cost of care is rising. Unfortunately, this increase in prices is doing so at rates that leave many at risk as they approach their golden years.

Just five years ago, the cost of in-home care ranged from $18-22 per hour. This was feasible for families who needed the additional help. However, prices today range from $28-40+ an hour. This range of prices continues to drive individuals out of the market for in-home care. Along with this increase has come a caregiver shortage, and hesitancy on the agencies to pay the wages that are being demanded. The combined scenario is a lose, lose for many families.

Expenses Associated with Aging

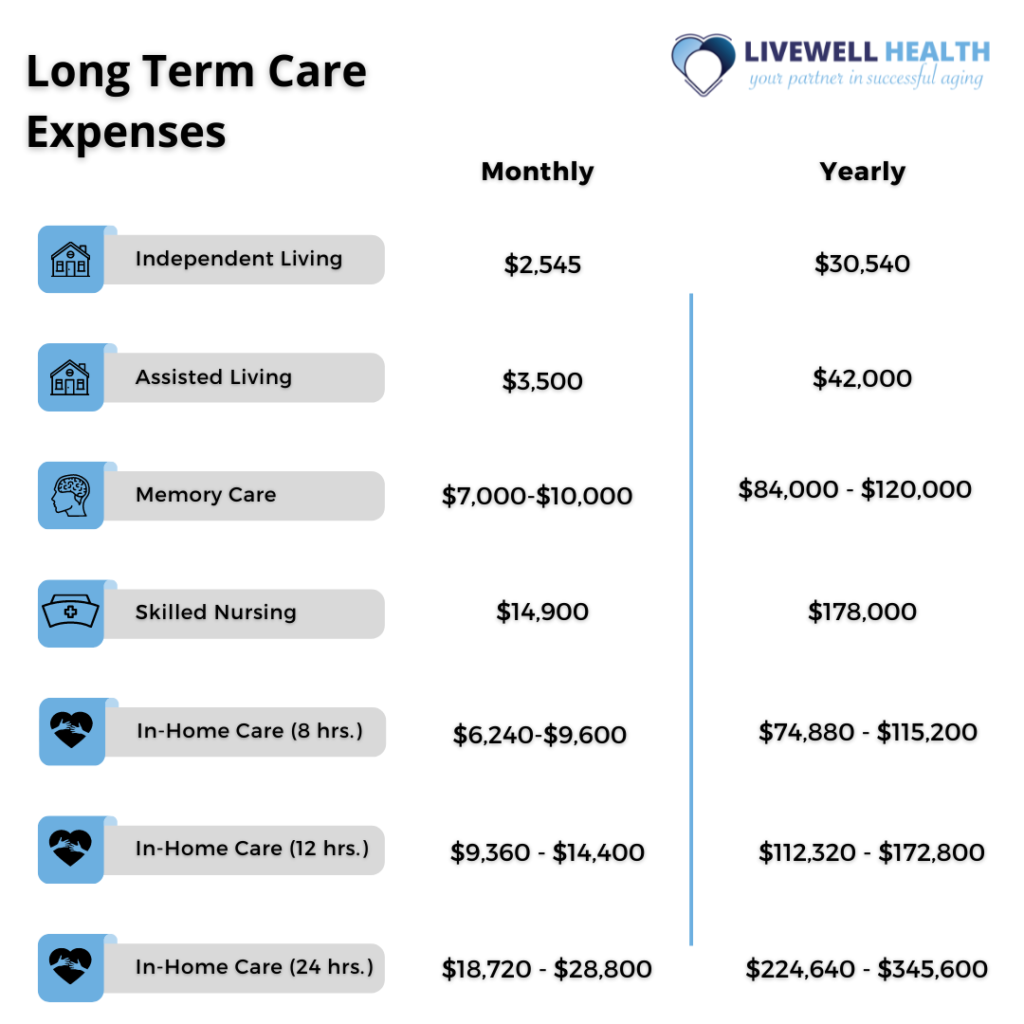

When viewing the illustration above, one can note true potential of expenses related to the aging process. Many often believe, “that won’t happen to me”, when in fact the above happens to a majority of individuals. As it stands, many individuals aim to have a nest egg of $1,000,000 by the time they retire. Unfortunately, many do not reach this milestone. However, for the sake of discussion, we will use 1,000,000 to see how far it really goes. According to CNBC, the median net worth of an individual aged 75 and older is $254,000. Let’s see how the numbers from above play out with a fraction of the million dollar goal.

- Independent Living: ~8 Years

- Assisted Living: ~6 Years

- Memory Care: ~2 Years

- Skilled Nursing: ~1 Year

- In-Home Care (8 hours daily): ~2 Years

- In-Home Care (12 hours daily): ~1.5 Years

- In-Home Care (24 hours daily): Less than 1 year

The Cold Truth

Of course, the more prepared you are for the future, the better, but, Americans live the greatest number of years in poor health compared to other developed countries. In the United States, the average length of life lived in poor health is 12 years. Therefore, those who have prepared for these long term expenses will of course be in a greater position than those that have not. One cannot simply expect for the final year or two of life to be lived in poor health.

Building Wealth Sure Helps

When it comes to protecting your assets you’d probably think you’d be sitting down with a financial advisor to do so. What if when you sat down with your financial advisor there was a personal trainer or fitness professional alongside him or her? What would you think? Would you believe the conversation was going to be a waste of time?

There are two ways to build wealth, one is to obtain assets that grow overtime. This can come in the form of retirement accounts, businesses, and so much more. The other way to build wealth is to protect those assets. How does one protect assets such as a retirement account? Yes, of course, they can be placed into a trust in which they are protected from litigation and such. We can build wealth by allowing those assets to grow. That is, we don’t access them for expenses such as the ones mentioned above. You can do so by taking a proactive approach to your health. The individual that remains healthiest for the greatest period of time will spend far less in healthcare related expenses compared to the individual who spends 12 years in poor health. The individual who prioritizes their own health will live a life free of disease and disability while maintaining his or her account balances should a crisis occur.